30+ Mileage Reimbursement Calculation

Web These tools make it easy to calculate your reimbursable mileage. Airplane nautical miles NMs should be converted into statute miles SMs or.

Rate Hrs Centralreach Help Supportcentralreach Help Support

Web In addition to time tracking we track and automatically calculate mileage and expenses.

. Web GSA has adjusted all POV mileage reimbursement rates effective January 1 2023. Customize smart locations favorite trips work hours and more. It can also help you find out the cost of an upcoming road trip and.

Web IR-2022-234 December 29 2022. Web 17 rows Find optional standard mileage rates to calculate the deductible cost of. Web IR-2022-124 June 9 2022 WASHINGTON The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months.

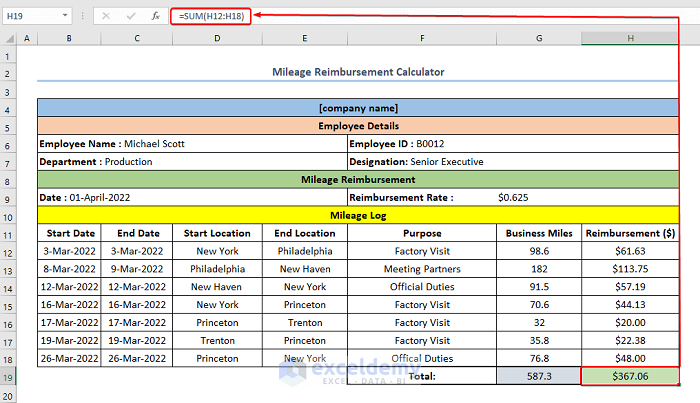

To find your reimbursement you multiply the number of miles by the rate. In this example business mileage. In the mileage reimbursement calculator youll have an area to input your miles driven.

Employees can even upload pictures of receipts right from their phones. Web How to calculate mileage reimbursement To calculate a mileage reimbursement multiply the miles driven by the mileage reimbursement rate typically the standard. Powerful tracking thats simple to use and manage.

Web This can also include reimbursement for company mileage. Web WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an. Web You can calculate the percentage of how many business miles youve driven by dividing the business miles by the total miles 100400025.

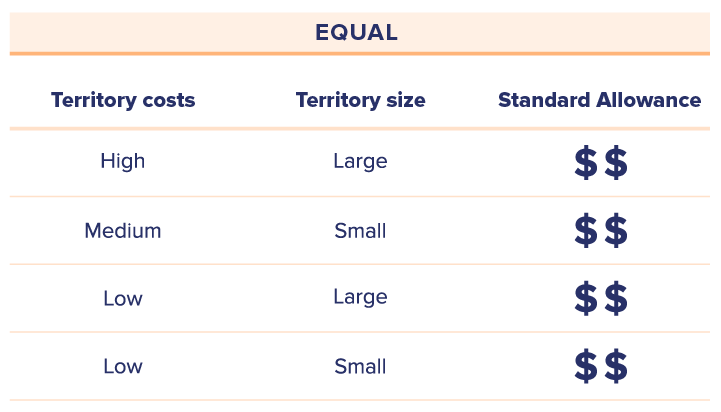

The sum of their trip mileage should then be multiplied by the. Set a fixed rate like 655 cents per. As mentioned above many companies peg the reimbursement rate to the rate set by the IRS.

Web Using a mileage calculator can help you figure out how much you should be reimbursed for work-related travel. Web Each employee must also add up their trip mileage through the pay period whether that be daily weekly or biweekly. Web These methods include.

Miles rate or 175. Ad Trusted by over 2 million users. Web To calculate your total reimbursement you would need to multiply the miles you have driven by the appropriate IRS mileage rate for 2023.

This is one of the most common methods for calculating mileage reimbursement. Web How To Calculate Mileage Reimbursement In 2023 In this article well cover how to calculate mileage reimbursement in 2023 and go over the best tools for. Web The 2023 standard mileage rate is 655 cents per mile.

WASHINGTON The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the.

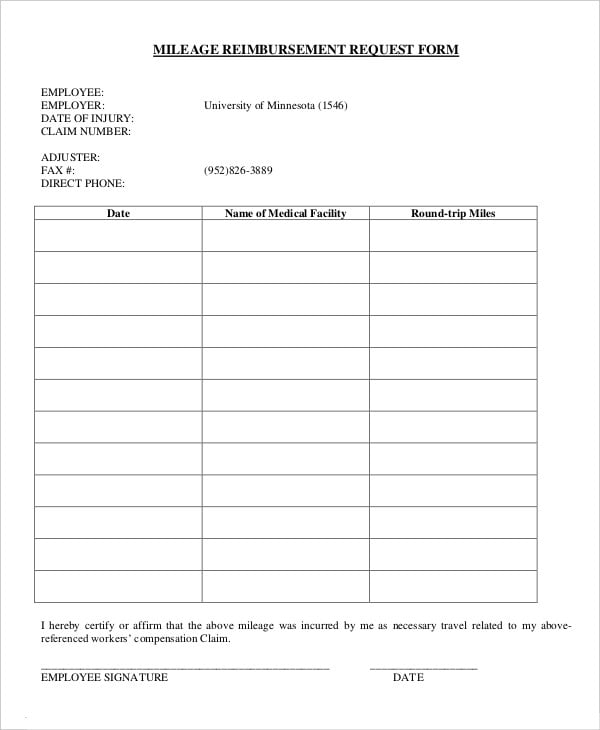

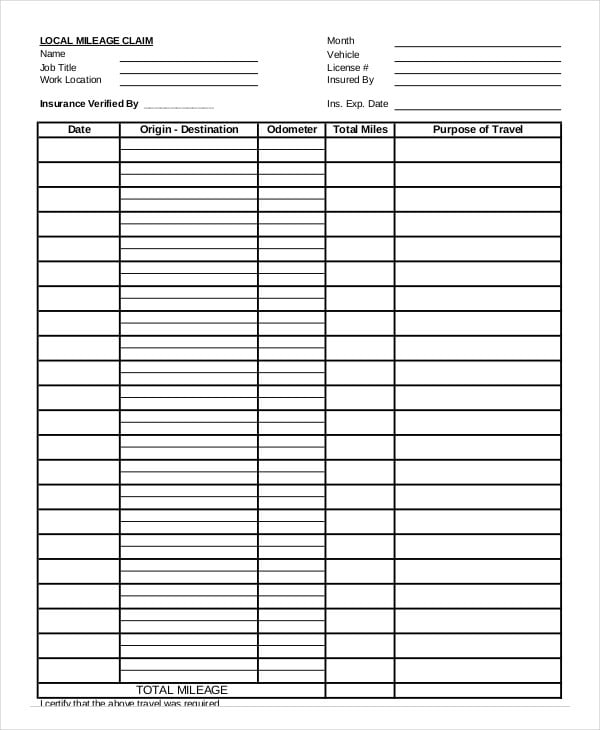

Mileage Reimbursement Form 10 Free Sample Example Format

Mileage Reimbursement A Complete Guide Travelperk

How To Calculate Mileage Reimbursement Irs Rules Mileiq Mileiq

The 8 Best Car Rental Apps For Business And Leisure Travelers Travelper

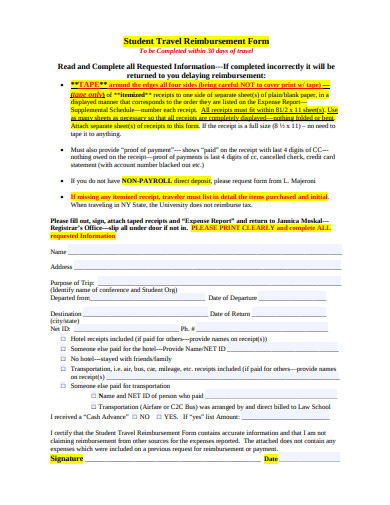

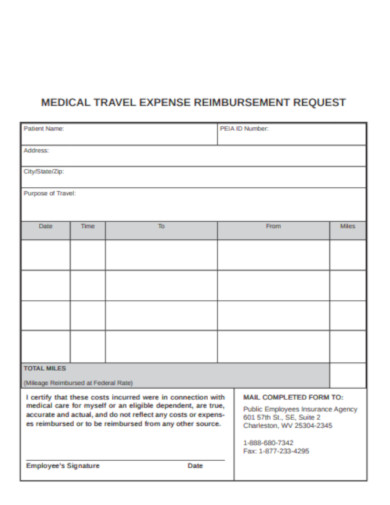

Travel Reimbursement Form 15 Examples Format Sample Examples

Free Irs Mileage Calculator Calculate Your 2023 Business Mileage

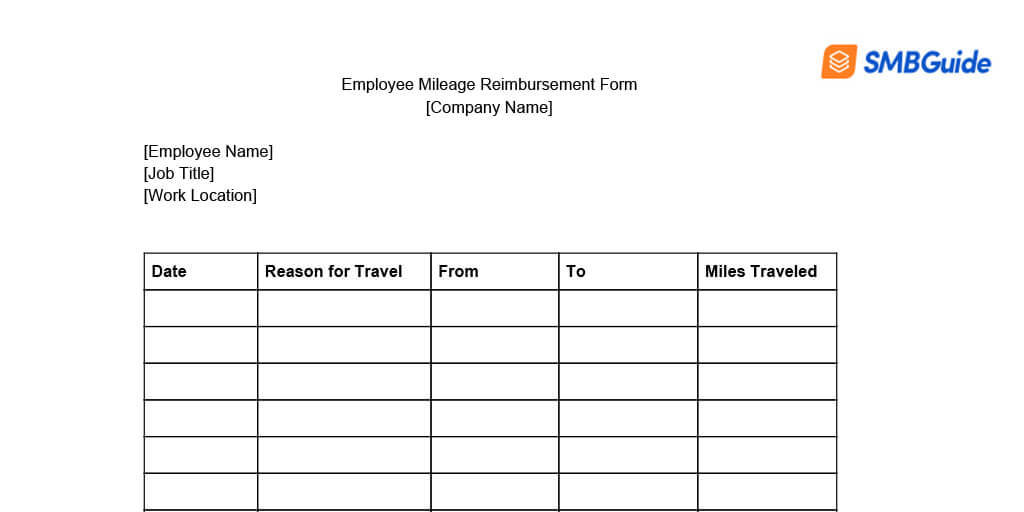

Mileage Reimbursement For Employees Info Free Download

Everything You Need To Know About Mileage Reimbursements

2023 Mileage Reimbursement Calculator Travelperk

How To Calculate Mileage Reimbursement In 2023

Free Irs Mileage Calculator Calculate Your 2023 Business Mileage

Business Mileage Deduction 101 How To Calculate For Taxes

How To Calculate Mileage Reimbursement In Excel Step By Step Guide

Mileage Tracking Spreadsheet Google Sheets Mileage Tracker Etsy

Mileage Reimbursement Form 10 Free Sample Example Format

Confluence Mobile Stsci Outerspace

Travel Reimbursement Form 15 Examples Format Sample Examples